SAMCO’s RankMF launches SmartSwitch News Release

SAMCO Group – Company Profile

SAMCO Group, is a fintech start-up which is one of India’s fastest growing companies in the Discount Broking Industry with over 1,10,000 customers. The company aims to solve problems and at an extremely affordable cost for its customers who actively trade or invest in the Indian capital markets with the use of algorithm, data science and artificial intelligence. SAMCO strives to provide some of the most unique margin products to enable its customers make the most efficient use of their capital and dodge complex problems like high brokerage and inefficient capital allocation that plague the trading and investing industry. SAMCO Group Limited is headquartered in Mumbai in India.

Earlier in 2018, the company had raised $7.5 Mn (INR 49 Cr) in a Series B funding round from existing promoters and London-based investment management firm Bay Capital Investment Partners. Prior to that Series A funding of $3 Mn (INR 20 Cr) was raised by the company in FY 2016. Different investment tools offered on SAMCO plat form such as StockNote, RankMF, StockBasket CashPlus, SmartSIP, Option Fair Value Calculator, Risk Advisor, Data Bank, Stock Ratings ease the process of saving and creating wealth.

About Rank MF:

Rank MF is an innovative and first-of- its- kind research cum distribution platform in India that objectively and scientifically evaluates mutual funds schemes using proprietary algorithms and big data science considering over 20 million data points covering all available 1000s of mutual funds schemes for investors that would ot herwise be humanely impossible. Rank MF is Revolutionizing the Selection of “SAHI” Mutual Funds at “SAHI” time to guide regular Investors to know the “most important” investment guidance “kaunsa mutual fund sahi hai”.

About StockNote:

StockNote is one of simplest and quickest apps to trade in the stock and commodity market in India, providing the user with a seamless and hassle free trading experience. There is no need to place order only after adding the respective script to the watch list. The app offers best charting tools of the world and various chart types like candles, bar, line, mountain charts, etc. It provides more than 100 types of indicators or tools for technical analysis. It provides charts for different time frames like intraday / historical, minutes, hourly, daily, weekly, monthly, etc. For the first time, it also provides continuous charts for futures contracts free of cost.

RankMF Launches India’s First Mutual fund Portfolio Sanitization Tool: SmartSwitch

- India’s first revolutionary mutual fund portfolio evaluation and recommendation tool

- Investors will be able to evaluate their current mutual fund portfolio, check their portfolio score and switch poor-performing funds into new recommended funds

- #RankMFSmartSwitch

Mumbai, 7th July 2020: RankMF, a Samco Group brand, announces the launch of a new and superior portfolio upgradation tool, ‘SmartSwitch’. RankMF’s SmartSwitch is a revolutionary mutual fund portfolio evaluation and recommendation tool that helps to analyse your existing mutual fund portfolio giving quality score on various parameters like

- Quality of existing mutual funds

- Category of mutual funds

- Over or under exposure to specific fund or category

- Over or under diversification

SmartSwitch uses RankMF’s proprietary research and rating engine to recommend switching of poor-performing schemes with high quality recommended schemes.“Approximately 11 lakh crores of AUM is stuck in less than 4 stars rated funds. It is important that these investors let go of their emotions to stay invested in these poor-quality funds and shift their investments to good quality funds to avoid further losses,” highlighted Mr. Jimeet Modi, CEO, Samco Group.

“If you are someone who has invested money with great discipline and still haven’t made gains over a long period means there are great chances that you have invested your money in the wrong mutual funds. SmartSwitch will help investors get a quality score for their portfolio, get specific recommendations and then will allow them to switch poor-quality funds to better-recommended funds,” he added further.

In the past 1 year

- 89% of AUM in Large-Cap Category has given negative returns of 5% to 22%.

- 86% of AUM in Multi-Cap Category has given negative returns of 5% to 27%.

- 99.5% of AUM in Small-Cap Category has given negative returns of 5% to 26%.

- 82% of AUM in Mid-cap Category has given negative returns of 5% to 18%.

* Data as on 1st July, 2020 – Source AMFI.

The above data statistics clearly emphasize starting your new mutual fund’s investments in the right funds.

Mr. Omkeshwar Singh, Head – Rank MF, Samco Group commenting on the launch added that, “Choosing the right funds is the main objective when investing in Mutual Funds. The funds can in turn give negative returns after some time and that investor can end up having an over-diversified portfolio. SmartSwitch is a revolutionary solution for these investors. They can simply upload their eCAS, check their portfolio score and switch their existing investments from poor quality or non-performing funds to a recommended quality mutual fund portfolio.”

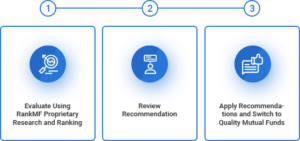

How Does SmartSwitch Work?

RankMF provides the only mutual fund research which does not rate and rank mutual funds on past performa nce. RankMF takes into consideration a variety of factors into consideration and over 20 million data points such as expense ratios, standard deviation, beta, market valuations, and multiples, portfolio holdings and diversifi ca tion /concentration of portfolio, the cash ratio of a fund, size of the fund, the predicted yields and we can go on and on, however one of the most important factors is the actual portfolio quality of holdings since that is what is going to deliver investor returns.

About Samco Group Ltd:

SAMCO Group , is a fintech start-up headquartered in Mumbai, which is one of India’s fastest growing compani es in the Discount Broking Industry with over 110,000 customers. The company aims to solve problems and at an extremely affordable cost for its customers who actively trade or invest in the Indian capital markets with the use of algorithms, data science and artificial intelligence.

Earlier in 2018, the company had raised $7.5 Mn (INR 49 Cr) in a Series B funding round from existing promoters and London-based investment management firm Bay Capital Investment Partners. P rior to that Series A funding of $3 Mn (INR 20 Cr) was raised by the company in FY 2016. Different investment tools offered on SAM CO plat form’s such as StockNote, RankMF and StockBaskets whi ch eases the process of saving and creating wealth.

For more information, please visit the website: https://www.samco.in/

Omkeshwar Singh Head- RankMF at Samco Group

Omkeshwar Singh has an overall experience of nearly 2 decades in broking and mutual-fund industry. He has worked with established companies such as BSE Ltd, ROMS Management Services Pvt. Ltd, Anand Rathi, Net worth Stock Broking Ltd, Karvy Group wherein he was instrumental in setting up their businesses right from scratch.

Prior to joining SAMCO Group, he was heading- BSE STAR Mutual Funds Market Segment (Bombay Stock Exch ange Limited) for over 5 years, and he was managing India’s largest mutual funds distribution infrastructure. Om keshwar is a leader in financial service sector with a proven track record of setting and scaling new business lin es for organisations. He comes with an entrepreneurial mind-set and has keen interests to build new ventures.