Paytm’s payment instruments have helped the company build a multi-stack payment architecture and bring it revenue

Chennai, 25 August 2021: India’s leading digital payments and financial services player Paytm filed its Draft Red Herring Prospectus for its $2.2 billion Initial Public Offering on 15th July 2021. The prospectus gives an insight into the business model of the company and how Vijay Shekhar Sharma has envisioned building India’s largest financial services giant.

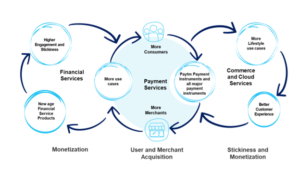

One of the interesting aspects is how Paytm has built its flywheels to create a complete network effect and a multi-stack payment architecture.

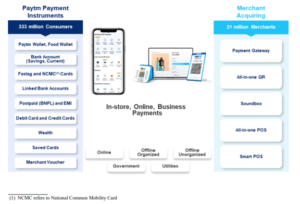

Paytm has built a strong base in India, with multiple payment instruments. These instruments include prepaid payment instruments such as Paytm Wallet, sub wallets and prepaid card; Savings account, current account, debit cards, FASTag, National Common Mobility Card, and Unified Payments Interface (“UPI”) handle, which are issued or opened by Paytm Payments Bank, and Paytm Postpaid, equated monthly instalment, credit cards, amongst others, issued by our financial partners. The company has listed the same in its competitive strengths, as it said, “Our payments platform, with a wide selection of daily life use cases and payment instruments, provides us with large scale and reach.”

It is the only payments company in India, along with its affiliates who own each layer of the payment stack. The power of these payment instruments is that it gives Paytm revenue. “Given the comprehensive nature of our pa yments platform, we believe that we have better ability to monetize the payments business because we are not dependent on one or few payment methods where monetization potential is low or zero. Some of the payment instruments like credit cards and payment methods like in-store devices have a much higher monetization po tential than the more widely used payment forms,” the company said in its DRHP.

As stated in the company’s DRHP, Paytm is the largest payment gateway aggregator in India based on total transactions, for the fiscal year ended March 31, 2021, with the widest ecosystem of payment instruments.

Additionally, this also gives users the flexibility to choose between different payment instruments and pay as per their convenience.