Paras Defence and Space Technologies Limited’s initial public offering to open on September 21, 2021

- Price Band of ₹ 165 – ₹ 175 per equity share bearing face value of ₹ 10 each (“Equity Shares”).

- Bid/Offer Opening Date – Tuesday, September 21, 2021 and Bid/Offer Closing Date – Thursday, September 23, 2021.

- Minimum Bid Lot is 85 Equity Shares and in multiples of 85 Equity Shares thereafter.

- The Floor Price is 16.50 times the face value of the Equity Share and the Cap Price is 17.50 times the face value of the Equity Share.

Risks to Investors: • The Book Running Lead Manager associated with the Offer has not handled any public issues in the past three years. • The Price/ Earnings ratio based on diluted EPS for Fiscal 2021 for the Company at the upper end of the Price Band is as high as 31.53. • Weighted Average Return on Net Worth for Fiscals 2021, 2020 and 2019 is 11.94%. • Average Cost of acquisition of Equity Shares for the Selling Shareholders, namely Sharad Virji Shah, Munjal Sharad Shah, Ami Munjal Shah, Shilpa Amit Mahajan and Amit Navin Mahajan, is ₹ 1.21, ₹ 3.36, ₹ 0.00, ₹ 0.00 and ₹ 0.00, respectively, and the Offer Price at the upper end of the Price Band is ₹ 175 per Equity Share.

Chennai, September 16, 2021: Paras Defence and Space Technologies Limited (“Company”); one of the ‘Indigenously Designed Developed and Manufactured Company’ (“IDDM”) category private sector companies in India, primarily engaged in designing, developing, manufacturing and testing of a wide range of defence and space engineering products and solutions.

The Company is proposing to open its initial public offering of Equity Shares (the “Offer”) on Tuesday, September 21, 2021 and closes on Thursday, September 23, 2021. The price band for the Offer has been determined at ₹ 165 – ₹ 175 per Equity Share.

The Offer comprises of a fresh issuance of Equity Shares aggregating up to ₹ 1,406 million (“Fresh Issue”) and an offer for sale of up to 17,24,490 Equity Shares by Sharad Virji Shah, Munjal Sharad Shah (the “Promoter Selling Shareholders”) and Ami Munjal Shah, Shilpa Amit Mahajan and Amit Navin Mahajan (the “Individual Selling Shareholders”, and together with the Promoter Selling Shareholders, “Selling Shareholders”)

The Company intends to utilize the net proceeds from the Fresh Issue towards purchase of machinery and equipment, funding incremental working capital requirements, repayment or prepayment of all or certain borrowings and for general corporate purposes.

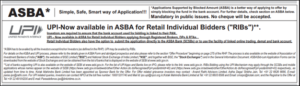

The Company and the Selling Shareholder have, in consultation with the book running lead manager to the Offer, considered participation by Anchor Investors in accordance with the SEBI ICDR Regulations, whose participation shall be one Working Day prior to the Bid/Offer Opening Date, i.e. Monday, September 20, 2021. The Offer is being made in terms of Rule 19(2)(b) of the Securities Cont racts (Regulation) Rules, 1957, as amended, read with Regulation 31 of the SEBI ICDR Regulations. The Offer is being made through the Book Building Process, in compliance with Regulation 6(1) of the SEBI ICDR Regulations, wherein not mor e than 50% of the Offer shall be available for allocation to Qualified Institutional Buyers, not less than 15% of the Offer shall be available for allocation to Non-Institutional Investors and not less than 35% of the Offer shall be available for allocation to Retail Individual Investors.

As per the “Defence and Space Industry Report” prepared by Frost & Sullivan (“F&S Report”), the Company, is amongst India’s leading private sector Company catering to four major segments of Indian defence sector namely, defence optics, defence electronics, electro-magnetic pulse (“EMP”) protection solution, and heavy engineering for defence and niche technologies. The Company is the sole Indian supplier of critical imaging components such as large size optics and diffractive gratings for space applications in India. The Company manufactures high precision optics for the defence and space applications such as thermal imaging and space imaging systems. As per the F&S Report, it is the only Indian Company to have the design capability for space-optics and opto-mechanical assemblies.

The Company has contributed towards some of the most prestigious defence programmes; and under its defence electronics operations it has managed to provide a wide array of high performance computing and electronic systems for defence applications, including sub systems for border defence, missiles, tanks and naval applications. The Company has undertaken and delivered customized turnkey projects in the defence segment, especially in the defence electronics and EMP protection segments. Currently, the Company operates through two manufacturing facilities in Maharashtra, located at Nerul (Navi Mumbai) and Ambernath (in Thane).

At the domestic front, the Company’s customer base ranges from government organizations involved in defence and space research to various defence public sector undertakings like Bharat Electronics Limited (BEL), Electronic Corporation of India Limited (ECIL) and Hindustan Aeronautics Limited (HAL); and supply products and solutions to private entities including Tata Consultancy Services Limited, Solar Industries India Limited and Alpha Design Technologies Limited. The Company has also catered to various foreign customers.

Anand Rathi Advisors Limited is the book running lead manager to the Offer (“BRLM”).

All capitalized terms used herein and not specifically defined shall have the same meaning as ascribed to them in the red herring prospectus dated September 13, 2021 (“RHP”) filed with the Registrar of Companies, Maharashtra at Mumbai (“RoC”).

Disclaimers: PARAS DEFENCE AND SPACE TECHNOLOGIES LIMITED is proposing, subject to receipt of requisite approvals, market conditions and other considerations, to make an initial public offering of the Equity Shares and has filed the RHP with the RoC and thereafter with SEBI and the Stock Exchanges. The RHP shall be available on the website of the SEBI at www.sebi.gov.in as well as on the website of the Book Running Lead Manager, i.e., Anand Rathi Advisors Limited, at www.rathi.com and Stock Exchanges at www.nseindia.com and www.bseindia.com. Investors should note that investment in the Equity Shares involves a high degree of risk and for details relating to such risks, see “Risk Factors” on page 19 of the RHP. [This announcement does not constitute an offer of Equity Shares for sale in any jurisdiction, including the United States, and the Equity Shares may not be offered or sold in the United States absent registration under the U.S. Securities Act of 1933 or an exemption from registration. Any public offering of the Equity Shares to be made in the United States will be made by means of a prospectus that may be obtained from the Company and that will contain detailed information about the Company and management, as well as financial statements. However, the Equity Shares are not being offered or sold in the United States.

DISCLAIMER CLAUSE OF SECURITIES AND EXCHANGE BOARD OF INDIA (“SEBI”): SEBI only gives its observations on the draft offer documents and this does not constitute approval of either the Offer or the specified securities stated in the Offer Document. The investors are advised to refer to page262 of the RHP for the full text of the disclaimer clause of SEBI.

DISCLAIMER CLAUSE OF BSE (Designated Stock Exchange): It is to be distinctly understood that the permission given by BSE should not in any way be deemed or construed that the RHP has been cleared or approved by BSE nor does it certify the correctness or completeness of any of the contents of the RHP. The investors are advised to refer to the page 264 of the RHP for the full text of the disclaimer clause of the BSE.

DISCLAIMER CLAUSE OF NSE: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Offer Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Offer Document. The investors are advised to refer to page 264 of the RHP for the full text of the disclaimer clause of NSE.

For further details in relation to the Company, BRLM, Compliance Officer of the Company, availability of application forms and RHP, please refer to statutory advertisement dated September 13, 2021.