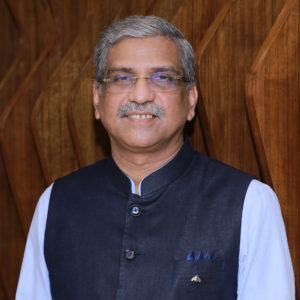

MD and CEO of ESAF Small Finance Bank, K. Paul Thomas has been elected as the Chairman

ESAF Small Finance Bank MD Paul Thomas elected as Chairman of Sa-Dhan

MD and CEO of ESAF Small Finance Bank, K. Paul Thomas has been elected as the Chairman of Sa-Dhan, the la rgest association of community development finance institutions in India. The announcement was made at 22nd Annual General Meeting of Sa-Dhan. Mukul Jaiswal, MD, Cashpor Micro Credit is elected as Co-Chair and HP Singh, CMD, Satin CreditCare Network Ltd is elected as Treasurer of Sa-Dhan.

Commenting on the new role, Mr K. Paul Thomas said that he is positively looking forward to as the Chairman of Sa-Dhan, the old est organization of financial inclusion institutions in the coun try. “Sa-Dhan has played a crucial role in building the standard practice norms for the sector. I strongly believe in the importance of promoting re sponsible finance to protect the interests of underserved and unserved borrowers,” he said.

Sa-Dhan is a Rese rve Bank of India recognized self-re gulatory org ani zation for non-ba nking financial com panies and microfi nance institutions. K. Paul Thomas is the Founder of ESAF Group of Soc ial Enterprises. He has been a management professional for over 32 years out of which more than 25 years are in the financial inc lusion sector.

About Sa-Dhan

Sa-Dhan came into being on July 21, 1999 with a mission to build community development finance in India. It h elps its member and associate institutions to better serve low-income households, particularly women, in both rural and urban India, in their quest for establishing stable livelihoods and improving quality of life.Sa-Dhan has 242 members reaching out to 29 states/UTs and 573 districts; it includes SHG promoting institutions, MFIs (For Profit and Not For Profit), banks, rating agencies, capacity building institutions etc. Sa-Dhan’s members follow diverse legal forms and operating models to reach out to approximately 33 million clients with loan outstanding of more than Rs. 33,000 crores.

About ESAF Small Finance Bank

The journey of ESAF began in a small house named ‘Little’ at Thrissur in 1992. Contrary to what the name soun ds, ESAF Society was launched with a bigger vision of sustainable holistic transformation of the poor and the ma rginalized. The success of Grameen bank in Bangladesh reinforced the vision of K. Paul Thomas the Founder and Managing Director of ESAF. In 1995, he launched Micro Enterprises Development (MED) services and it resulted in the formation of ESAF Microfinance and Investments Pvt. Ltd., in 2008. The increased focus on microfinance was inevitable as the founder was clear in his understanding of the importance of financial component in holistic economic development of the poor.

Gradually, ESAF Microfinance earned its place among the top ten Microfinance institutions in India.In 2015, the Reserve Bank of India, the financial regulator in the country has granted in-principle license to ESAF to launch a Small Finance bank. ESAF Small Finance Bank was one amongst the ten NBFCs to receive an ‘in principle’ approv al from the Reserve Bank of India (RBI) to set up a Small Finance Bank in the private sector. In November 2016, t he final license was issued by the RBI. ESAF Small Finance Bank was incorporated on May 05, 2016, with its regis tered office in Thrissur.