ManipalCigna Health Insurance registers robust 37% increase in gross written premium at ₹500+ Crore in South India in FY 22-23, expects market to double in the next 2 Years

- ManipalCigna Health Insurance continues to deepen its presence across India and the southern markets, with its innovative health insurance solutions

- The standalone health insurance company has 3,300+ network hospitals in South India and 8,700+ hospitals across the country

- As part of its expansion in the southern region, the Company aims at launching new branch offices and plans to hire more employees and nearly 10,000 agents in FY24

Chennai, July 25, 2023 – ManipalCigna Health Insurance, one of India’s fastest-growing standalone health insur ance company, strengths its presence across India and southern markets to cater to the healthcare financing nee ds and reach new customers segments with its innovative health insurance solutions. Leveraging its strong mult i-channel distribution network and multi-product offerings, the insurer remains steadfast in its mission to enhan ce health insurance penetration in the southern market and provide its customers with easy and lifetime access to quality healthcare.

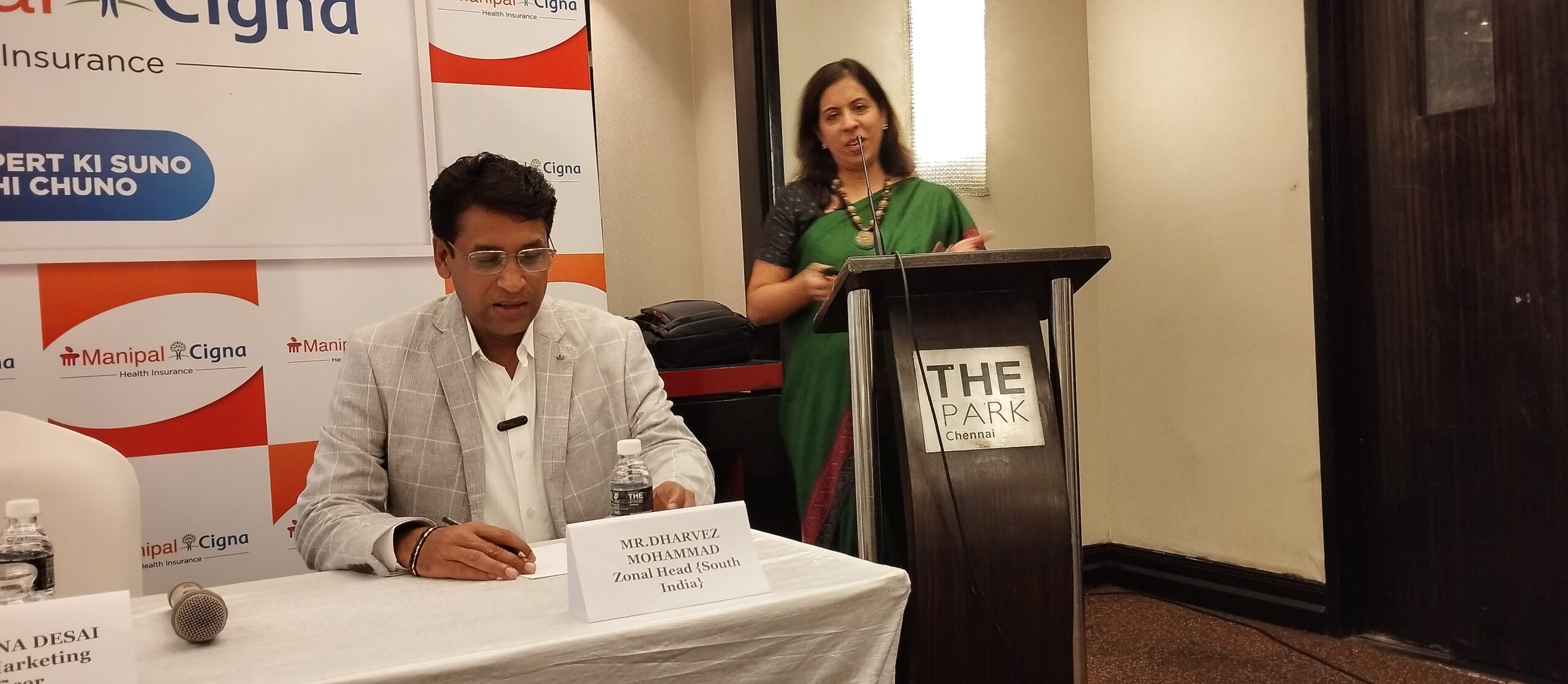

As health insurance expert, ManipalCigna Health Insurance saw a robust growth from the southern region – And hra Pradesh, Karnataka, Kerala, Telangana and Tamil Nadu. The Company has garnered over ₹500 Crore gross w ritten premium (GWP) with 37% growth in the financial year 22-23 in the southern region. ManipalCigna has clo se to 20,000 advisors, major partners present in around 5,000 point of sales locations across the region through distribution network, and 25 branch offices in South India. Further, the standalone health insurance company ha s 3,300+ network hospitals in South India, out of the 8,700+ pan-India hospitals across the country. As part of its expansion in the southern region, ManipalCigna Health Insurance aims at launching new branch offices and plan s to hire more employees and nearly 10,000 agents for South push in FY24 and expects its business to double to ₹1000+ crore GWP in the next 2 years.

ManipalCigna Health Insurance had a claim settlement ratio of 88.32% for the financial year 2022-23, demonst rating its strong commitment to offering better claims experience and honouring the financial security of policy holders and their families in times of needs.

Sapna Desai, Chief Marketing Officer, ManipalCigna Health Insurance, commented, “South India is one of the fa stest growing markets for us, and we at ManipalCigna are committed to making a positive impact on people’s he alth and financial well-being in the region. The partnership of Manipal Group’s local expertise – being the second largest hospital chain in India and Cigna Healthcare’s global experience has made us a truly differentiated health care financing provider. We believe that there is a substantial increase in the demand for health insurance due to the growing medical inflation, lifestyle diseases, communicable and non-communicable diseases, and we plan to continue on our growth journey in South India by providing affordable, predictable, and simple health insurance solutions to serve the evolving and diversified healthcare financing needs of our customers”

According to various industry reports, Tamil Nadu has been seeing high incidents of road traffic accidents, lifesty le diseases such as diabetes, hypertension, obesity, breast cancer and prevalence of chronic kidney diseases. Its death rate for heart diseases and Alzheimer’s is also higher than the national average. Thus keeping in mind the increasing healthcare incidences and cost, ManipalCigna Health Insurance has consistently introduced innovat ive products to address these needs.

Some of the customer-centric solutions that address the unique health insurance needs of customers are Manip alCigna Lifetime Health plan, a comprehensive healthcare financing solution that offers a high level of protecti on with Sum Insured ranging from Rs.50 lacs to Rs.3 crores for domestic and global coverage, Loyalty premium di scounts on the applicable renewal premium from 4th policy year onwards till lifetime, and other enticing benefit s to secure an individual’s and a family’s healthcare requirements at every stage of life. ManipalCigna also has a specialized solution for senior citizens, ManipalCigna Prime Senior plan that gives flexibility with immediate cov erage from 91st day onwards, so they have access to quality healthcare in the golden years of life. Another rema r kable solution is ManipalCigna ProHealth Prime, which also has a specific plan, for lives suffering from the med ical conditions such as Diabetes, Obesity, Asthma, high Blood Pressure and high Cholesterol.

Ashish Yadav, Head of Products, added, “At ManipalCigna Health Insurance, we continually strive to offer a ran ge of health insurance products to cater to the evolving healthcare financing needs of various customer segmen ts such as Lifetime Health, Prime Senior, amongst others that comes with many industry first features. Today 10 0% of our customer on-boarding across all segments is digital without any paperwork. Our newly launched mob ile app and chat bot enables our existing customers to avail our services 24/7 and anytime, anywhere. We at Ma nipalCigna are dedicated to helping people live their best lives with complete peace of mind, knowing that they have access to quality healthcare when they need it most.”

With innovative and customer-focused product solutions, ManipalCigna Health Insurance stands out as one of the trusted health insurance company in India, addressing the unique health needs of individuals and offering comprehensive coverage to take care of customer’s healthcare financing requirements.

For more information on ManipalCigna Health Insurance’s product portfolio of offerings, please visit the official website: https://www.manipalcigna.com/health-insurance

About ManipalCigna Health Insurance Company Limited

ManipalCigna Health Insurance Company Limited is a joint venture between Manipal Group, an eminent player in healthcare delivery and higher education in India, and Cigna Healthcare, a global health services company wit h over 230 years of experience. ManipalCigna is headquartered out of Mumbai and has 76 branch offices coveri ng significant metros and towns. The company has built a strong multi-distribution network of over 59,000 agen ts and 500+ distribution partners across the country. ManipalCigna also has presence in 400+ cities in India thro ugh its distribution network and has a network of over 8700 hospitals across cities including tier I, tier II, and tier III towns in India. To learn more, visit www.manipalcigna.com