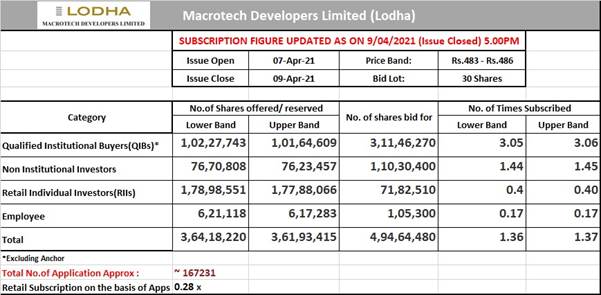

Macrotech Developers IPO final day: Issue subscribed 1.37 times, QIB portion booked 3.06 times

Chennai, April 9, 2021: Affordable and Mid Income Housing focused Macrotech Developers Limited also known as Lodha Developers; received bids of 4,94,64,480 shares against the offered 3,61,93,415 equity shares, as per the 5:00 pm data available on the bourses.

The portion reserved for Qualified Institutional Buyer category was subscribed 3.06 times While the, retail inv estors was subscribed 0.40 times. the Non-Institutional Investor category was subscribed 1.45 times.

The IPO was a fresh issuance of equity shares of Rs 10 face value aggregating up to Rs. 2500 crore. The minimum bid lot was of 30 equity shares, thereafter in multiples of 30 equity shares. The price band has been fixed at Rs. 483 – Rs. 486 per Equity Share.

Key brokerage houses like Axis Securities, Hem Securities, Rel iance Securities and Choice have given recommen dations of “Sub scribe” to the issue for long term perspective while highlighting the key strengths of the company li ke diversified Portfolio with strong focus on affordable & mid income housing segment, strong brand in MMR region. These report have further highlighted the strong project portfolio and monetization of huge land banks offer comfort. Moreover, its return ratio looks to be superior compared to peers. Company’s consistent track record of financial performance and experienced management as one of the key advantages of the Company.

Company Information

Macrotech Developers with strong footing of 570 lakh sq feet deliveries in FY 2014-20 in India, caters to hou si ng demands across consumer segments, delivers at scale and aims at providing quality homes to every aspiring home-buyer. The Group with its early entry in affordable and mid income housing in Mumbai region has deep un derstanding of the consumers segment and demonstrates 2/3 of its business from the segment. As recent as FY 2020, the affordable and mid income housing segment contributed 57.77% of the overall business for the group, further determines its strong focus and potential in the segment.It currently has 36 ongoing projects comprising approx. 28.78 mn sq feet Developable area of which 23.57 mn sq feet is in affordable and mid income housing. As on Dec 31,2020 it had 3803 acres with an estimated developable area of approximately 322 mn sq feet for futu re development in Upper Thane, Dombivali