Indel Money Limited Launches Public Issue of up to Rs. 200 crores of Secured, Redeemable Non-Convertible Debentures (NCDs) Secured NCDs of face value of Rs.1,000 each

The Issue includes a Base Issue Size for an amount of up to Rs.100 crores with an option to retain over-subscription up to Rs. 100 crores aggregating up to Rs.200 crores

issue opens on Tuesday, January 30th, 2024 and closes on Monday, February 12th, 2024

Doubling of investment in 72 months – Option VIII

Coupon yielding up to 12.25% per annum

Secured NCDs with tenure ranging from 366 days to 72 months

Minimum application size 10 NCDs (Rs.10,000) across all Options of NCDs

Chennai, 31 January 2024

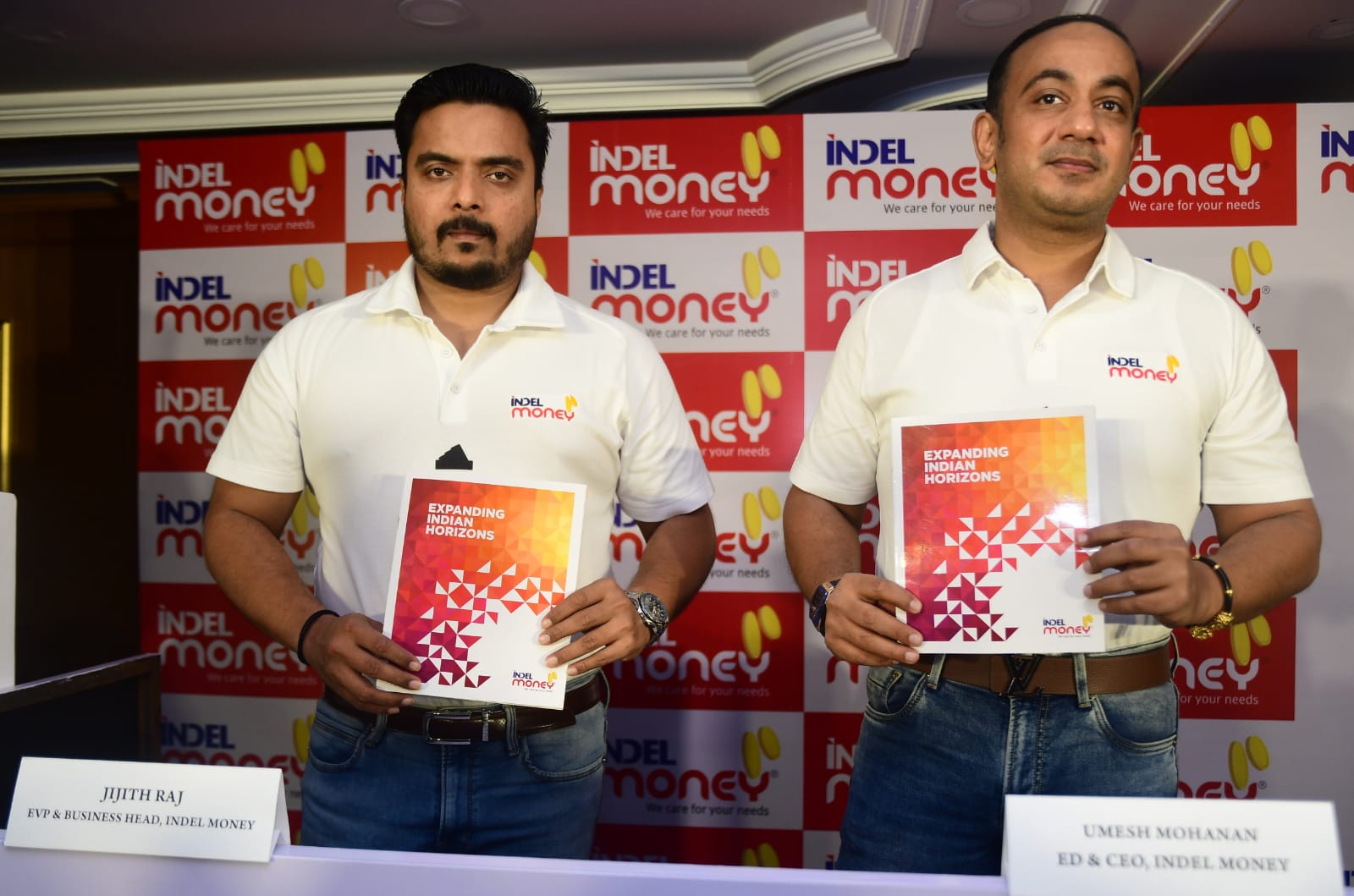

Indel Money Limited, one of the fastest growing NBFC in the gold loan sector, announced the 4th public issue of Secured NCDs of face value of Rs.1,000 each. The Issue opened on Tuesday, January 30, 2024 and will close on Monday, February 12, 2024 (with an option of early closure in case of early over subscription).

Mr. Umesh Mohanan, Executive Whole Time Director, Indel Money Limited said, “Our business strategy is designed to capitalize on our competitive strengths to enhance our position in the Gold Loan industry and to expand our presence. The first half of FY24 saw the company demonstrating a stellar performance with its profitability surging by a record 568.86% buoyed by a strong AUM growth, heightened demand for gold loans, expansion into newer territories and operational efficiencies despite a challenging business environment. Tamil Nadu has always been our primary strategic focus in the south Indian states. We aim to continue to grow our loan portfolio by expanding our branch network by opening new branches. Increased revenue, profitability and visibility are the factors that drive the branch network. With this issue, we aim to expand our sources of funds.”

The issue includes a Base Issue Size for an amount of up to Rs.100 crores with an option to retain over-subscription up to Rs.100 crores aggregating up to Rs.200 crores. The Lead Manager to the Issue is Vivro Financial Services Private Limited.

The funds raised through this issue will be used for the purpose of onward lending, financing and for repayment/prepayment of principal and interest on borrowings of the Company. Indel Money Limited had a total outstanding AUM (excluding off-balance sheet assets) amounting to Rs.81,740.86 lakhs as on September 30, 2023 as compared to Rs.64,768.53 lakhs as on March 31, 2023. Gold Loans takes up ~82% of the loan portfolio with a branch network of 250 branches as on September 30, 2023. Indel Money Limited intends to widen our geographic footprint by Fiscal 2025 to over 425 branches across 12 Indian states, expanding to eastern and northern states in India.Indel Money Limited had successfully launched 3 public issues of NCDs and raised more than Rs.260 crores.