Consolidated Key Performance Highlights for Q3FY22

Mumbai, February 12, 2022: The Board of Directors of Capri Global Capital Ltd. (CGCL), a non-deposit taking and systemically important NBFC (NBFC-ND-SI) today announced the un-audited financial results for the qu arter ended December 31, 2021.

Earnings

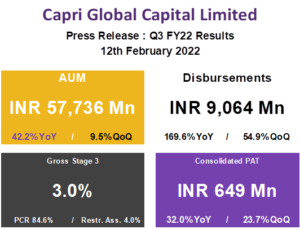

CGCL reported a Consolidated Profit after Tax of Rs 649mn, up 32% YoY. This is the highest ever consolidated PAT surpassing the previous high of Rs 608mn reported in Q2FY21. This was supported by a 45% YoY growth in net income to Rs1,716mn. Net interest margin for Q3FY22 was 10.3%. Expanding branch and people cost was reflected in the 63% YoY growth in operating expenses. However, the cost-income ratio softened on a sequential basis to 38.4%. Despite higher operating expenses, the operating profit growth was noted at a strong 35% YoY, reflecting the strength in core earnings. The annualized RoE touched 14.1% while RoA crossed 4% level after a year to touch 4.2%. The company maintains its +15% RoE guidance for medium term.

Balance Sheet

Disbursals increased 2.7x YoY to touch Rs 9,064mn while the AUM increased 42% YoY touching Rs 57,693mn. The AUM growth was balanced, driven by MS ME, Affordable Housing, and Construction Finance segments. The company com menced co-lending arrangement with State Bank of India and Union Bank of Indi a during Dec’21 and expects to generate strong growth through both these cha nnels in the next six months.

Liability Management

Outstanding borrowings increased 25% YoY to touch Rs 41,694mn. Borrowings were long term and well-di ver sified across 17 lending institutions. The cost of funds was 8.2%, lower 80bps YoY and unchanged QoQ. CGCL is well-funded and maintains a well-matched asset liability profile.

Asset Quality

Gross Stage 3 ratio was 3%, up 95bps YoY but lower 27bps QoQ. The Gross Stage 3 assets increased marginally over Q2FY22 to Rs 1,724mn.

Strong Capital Adequacy

Both CGCL and its housing finance subsidiary CGHFL are well capitalized with overall capital adequacy ratio at 35.2% and 30.0% respectively as of Q3FY22.

Founder & Managing Director Mr. Rajesh Sharma Announces CGCL’s Foray Into Gold Loans

“Secured retail lending has been a focus area for Capri Global and the company is pleased to announce expansio n of its retail offering by foraying into the gold loan business. Gold loans offer a vast growth potential for organiz ed players. Capri Global, with its expanding reach in Tier 2 and 3 markets in West and North India is well placed to tap into this potential. The company shall be targeting 1,500 branch locations and a gold loan book size of Rs 8,000 crores over the next five years.

CGCL’s Q3FY22 results are once again a testimony to its capability in driving sustainable growth and delivering value to its stakeholders. New products further enhance our growth outlook and put us firmly on path to deliver an overall AUM CAGR of +22% and a RoE of +15% over the medium term.”