Cloud communication platform provider, Route Mobile’s Rs. 600 crore initial public offer (IPO)

Route Mobile Subscribed 4.21 Times on Day 2 Retail investors portion 6.81 times

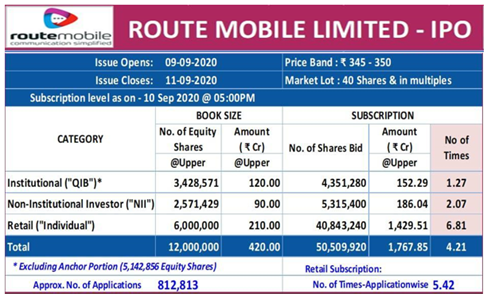

Chennai, September 10, 2020: Cloud communication platform provider, Route Mobile’s Rs. 600 crore initial public offer (IPO) was subscribed 4.21 times on the second day of bidding, i.e. September 10. The IPO received bids for 5.05 crore equity shares as against the offer size of over 1.21 crore shares, as per data available on the stock exchanges. The public offer will close on Friday i.e. September 11, 2020.

The retail investor’s portion, which was fully subscribed on the first day itself, received a total subscription of 6.81 times. The non-institutional investors segment attracted bids to the extent of 2.07 times and the portion set aside for qualified institutional buyers was subscribed 1.27 times. Route Mobile has fixed the price band at Rs. 345-350 per share.

The public offering will comprise fresh issue of up to Rs. 240 crore and offer for sale (OFS) of Rs. 360 crore. A retail investor can bid for a minimum one lot of 40 shares and in multiples of 40 shares thereafter, to a maximum of 14 lots. The shares will be listed on both, BSE and the NSE.

Ahead of the IPO, Route Mobile had raised Rs 180 crore from anchor investors, including Franklin Templeton Mutual Fund, Goldman Sachs, SBI Life Insurance, Kuwait In vestment Authority and Axis Mutual Fund. Route Mobile will utilise the proceeds of the fresh issue to repay existing debt, make acquisitions and purchase office premises in Mumbai, and for general corporate purposes.