CHOLAMANDALAM INVESTMENT AND FINANCE COMPANY LIMITED (CIFCL)

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 30th JUNE 2020

Quarterly PAT at ₹ 431 Cr Up by 37% (YoY)

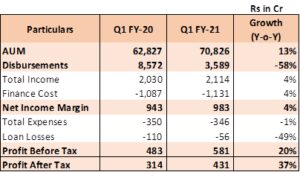

Key Financial results (Q1 FY 20-21):

- Total AUM up at ₹ 70,826 Cr (Up by 13% YoY)

- PBT up at ₹ 581 Cr for the Quarter (Up by 20% YoY)

- PAT up at ₹ 431 Cr for the Quarter (Up by 37% YoY)

Chennai, July 30, 2020: The Board of Directors of CIFCL today approved the unaudited financial results for the quarter ended 30th June 2020.

Highlights:

Due to the Covid-19 pandemic, the nation-wide lock down began in late March and subsequently extended till May 15th. Stringent restrictions halted most economic activities in the country. Post opening after May 15th, operations have gradually resumed and there has been an improved demand and we have been able to disburse Rs 3,589 Cr for the quarter. The Company’s tech initiatives and customer’s increased acceptance on digital lending amidst this Covid-19 pandemic are encouraging signs to look for in the near term.

Pursuant to the moratorium announced by RBI on EMI repayments, the company has granted moratorium to its customers for installments falling due between March and August. Nearly 74% of our customers have availed moratorium considering the uncertainty over the period of lockdown. However, post relaxations of lock down after May 15th, we witnessed traction with respect to collections from such moratorium availed customers, who have started paying their EMIs in advance. We have around 50% of our moratorium customers repaying partial or full installments. During the month of June, the Company also made lot of awareness calls/SMS to customers, explaining to them the impact of the moratorium availed by them.

The Company has not availed moratorium so far on its borrowings. The Company holds strong liquidity position with Rs. 7,169 Cr as cash balance as of Jun’20, with a total liquidity position of Rs.11,677 Cr (including undrawn sanctioned lines). The ALM is comfortable with no negative cumulative mismatches across all time buckets. Even after extending the moratorium to its customers, for the second phase, the cash position of the Company is adequate to meet all its maturities and fixed obligations till Dec 2020.

Financial snapshot

Performance Highlights:

Q1 Performance:

- Aggregate disbursements for the quarter ended June 20 were at ₹ 3,589 Cr as against ₹ 8,572 Cr in the previous year registering a decline of 58%. Disbursements started to pick up after lockdown relaxation post May 15th.

- Vehicle Finance (VF) business has clocked a volume of ₹ 3,231 Cr for the quarter ended June 2020 as against ₹ 6,940 Cr in the previous year, reporting a decline of 53% Y-o-Y. The disbursements were predominantly in Tractors, Two-wheelers, construction equipment and Used business segments.

- Loan Against Property (LAP) business disbursed ₹ 119 Cr as against ₹ 1101 Cr in the previous year, registering a decline of 89% YoY.

- Home Loan (HL) business disbursed ₹ 190 Cr as against ₹ 420 Cr in the previous year, registering a decline of 55% YoY.

- Assets under management grew by 13% at ₹ 70,826 Cr as compared to ₹ 62,827 Cr for the same quarter in FY20.

- Profits after Tax (PAT) for the quarter ended June 2020 were at ₹ 431 Cr as against Rs.314 Cr in the same period last year registering a growth of 37%.

- PBT-ROA for the quarter was at 3.6% as against 3.4% in the same quarter in FY20.

- ROE for the quarter ended June 2020 was at 20.6% as against 20.0% in the same quarter previous year

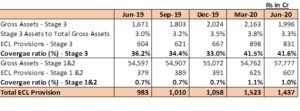

Asset Quality

CIFCL asset quality as on 30th June 2020, represented by Stage 3 assets stood at 3.3% with a provision coverage of 41.6%, as against 3.0% in Q1 of FY20 with a provision coverage of 36.2%. The Stage 3 assets have improved from 3.8% in Mar 20 to 3.3% in June 20.

The total additional provision carried for Covid and Macro is now Rs.551 crs as against Rs.534 crs as of March 20.

Capital Adequacy:

The Capital Adequacy Ratio (CAR) of the company as on 30th June 2020, was at 20.42% (As per Ind AS) as against the regulatory requirement of 15%.

We are happy to announce that, the Company has been included in the FTSE4Good Index Series, created by the global index and data provider FTSE Russell. The FTSE4Good Index Series is designed to measure the performance of companies demonstrating strong Environmental, Social and Governance (ESG) practices. The FTSE4Good indexes are used by a wide variety of market participants to create and assess responsible investment funds and other products.

FTSE Russell evaluations are based on performance in areas such as Corporate Governance, Health & Safety, Anti-Corruption and Climate Change. Businesses included in the FTSE4Good Index Series meet a variety of environmental, social and governance criteria.

Managing Director’s Comments:

Commenting on the results, Arun Alagappan, Managing Director, stated “It was a challenging quarter for the NBFC industry with muted disbursements and a slowdown in repayments due to the moratorium and lockdown. Chola’s response was comprehensive, with our treasury ramping up liquidity, our tech team identifying and deploying digital interventions for disbursements and collections, our analytics team being able to identify vulnerable segments and more importantly, our business teams adapting to the new normal of driving business despite working away from offices. Valuable learnings from these past few months shall remain with us for many more years to come.

While it was important to respond to the Covid-19 shock, it was also equally important for us to not lose focus of the company’s long-term aspirations. Optimizing the company’s cost structure was strategically important for us. The quarter gone by helped us critically evaluate our expenses, with an improvement already visible – our opex ratio has come down to 2.2% from 2.6% just a quarter before. During the quarter, we have initiated a comprehensive process transformation program for the vehicle finance business. The LAP business has rolled out its newly developed Loan Origination and Loan Management System during the quarter gone by.

Looking ahead, we expect disbursements to improve, considering our diversified product portfolio and pan India presence. We will also continue to retain our increased focus on the collections and cost fronts.”

About Cholamandalam

Cholamandalam Investment and Finance Company Limited (Chola), incorporated in 1978 as the financial services arm of the Murugappa Group. Chola commenced business as an equipment financing company and has today emerged as a comprehensive financial services provider offering vehicle finance, home loans, home equity loans, SME loans, investment advisory services, stock broking and a variety of other financial services to customers.

Chola operates from 1098 branches across India with assets under management above INR 70,000 Crores.

The mission of Chola is to enable customers enter a better life. Chola has a growing clientele of over 10 lakh happy customers across the nation. Ever since its inception and all through its growth, the company has kept a clear sight of its values. The basic tenet of these values is a strict adherence to ethics and a responsibility to all those who come within its corporate ambit – customers, shareholders, employees and society.

For more details, please visit www.cholamandalam.com

About Murugappa Group

Founded in 1900, the INR 381 Billion (38,105 Crores) Murugappa Group is one of India’s leading business conglomerates. The Group has 28 businesses including nine listed Companies traded in NSE & BSE. Headquartered in Chennai, the major Companies of the Group include Carborundum Universal Ltd., Cholamandalam Financial Holdings Ltd., Cholamandalam Investment and Finance Company Ltd., Cholamandalam MS General Insurance Company Ltd., Coromandel International Ltd., Coromandel Engineering Company Ltd., E.I.D. Parry (India) Ltd., Parry Agro Industries Ltd., Shanthi Gears Ltd., Tube Investments of India Ltd., and Wendt (India) Ltd.

Market leaders in served segments including Abrasives, Auto Components, Transmission systems, Cycles, Sugar, Farm Inputs, Fertilisers, Plantations, Bio-products and Nutraceuticals, the Group has forged strong alliances with leading international companies such as Groupe Chimique Tunisien, Foskor, Mitsui Sumitomo, Morgan Advanced Materials, Sociedad Química y Minera de Chile (SQM), Yanmar & Co. and Compagnie Des Phosphat De Gafsa (CPG). The Group has a wide geographical presence all over India and spanning 6 continents.

Renowned brands like BSA, Hercules, Montra, Mach City, Ballmaster, Ajax, Parry’s, Chola, Gromor, Shanthi Gears and Paramfos are from the Murugappa stable. The Group fosters an environment of professionalism and has a workforce of over 51,000 employees.

For more details, visit www.murugappa.com