Muthoottu Mini’s Non- Convertible Debentures (NCD) Issue Open

- Issue of Secured & Unsecured NCDs of face value of Rs. 1,000 each.

- The NCD Issue includes a Base Issue Size of Rs.125 crore with an option to retain oversubscription up to Rs.125 crore aggregating up to Rs.250 crore (“14th NCD Issue”).

- Secured NCD portion of upto Rs. 200 crore and Unsecured NCD portion up to Rs. 50 crs

- The 14th NCD Issue is rated as IND BBB: Outlook Stable by India Ratings and Research Private Limited.

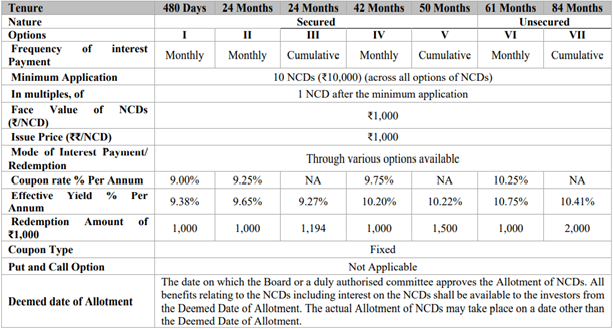

- The 14th NCD Issue offers effective annualized yield of up to 10.22% p.a. on redemption# for Secured NCDs and 10.41% p.a for Unsecured NCDs.

- The 14th NCD Issue opens on March 30, 2021 and closes on April 23 2021 (with an option of early closure).

- The NCDs are proposed to be listed on BSE Limited.

# For further details please refer Prospectus dated March 25, 2021.

Chennai, March 30, 2021: Incorporated in the year 1998, a systemically important non-deposit taking NBFC in the gold loan sector, Muthoottu Mini Financers Ltd.(“ Muthoottu Mini”/ ‘MMFL’), has announced the opening of its public issue of Secured and Unsecured Debentures (“NCDs”) of the face value of Rs. 1,000 each.

The 14th NCD Issue aggregates to Rs. 125 crore, with an option to retain over-subscription upto Rs. 125 crore, aggregating upto a total of Rs. 250 crore. The 14th NCD Issue offers various options for subscription of NCDs with coupon rates ranging from 9.00% – 10.25% p.a. The 14th Issue opens on March 30, 2021 and closes on April 23, 2021, with an option of early closure or extension.

As on 30th September 2020, MMFL had 3,69,019 gold loan accounts, predominately from rural and semi urban areas, aggregating to Rs. 1825.55 cr which accounted for 97.27% of its total loans and advances. Its net Non-Performing Assets for six-month period ended September 30, 2020 stood at 0.59%, lower from the March, 2020 reported net Non-Performing Assets of 1.34%.

The Company, erstwhile part of a family business enterprise that was founded by Ninan Mathai Muthoottu in 1887 is now spearheaded by Nizzy Mathew, Chairwoman & Whole-time Director and Mathew Muthoottu, Managing Director.

The terms of each options of NCDs, offered under Issue are set out below:

Net proceeds of the Issue will be utilized for the purpose of onward lending, financing, and for repayment/prepayment of principal and interest on borrowings of the Company (Atleast 75%) – and the rest (up to 25%) for general corporate purpose.

The Secured and Unsecured NCDs offered through Prospectus dated March 25, 2021 are proposed to be listed on the BSE.

The Lead Manager to the Issue is Vivro Financial Services Private Limited

Vistra ITCL (India) Limited is the Debenture Trustee and Link Intime India Private Limited is the Registrar to the Issue.

About Muthoottu Mini Financiers Limited: (RBI Registration No: N-16.00175)

Muthoottu Mini Financiers Limited is a RBI registered non-deposit taking systemically important NBFC in the loan against gold financing sector, lending money against the pledge of household gold jewellery for over 2 decades. As on December 31, 2020 the Company had a network of 804 branches spread in the states of Kerala, Tamil Nadu, Karnataka, Andhra Pradesh, Telangana, Haryana, Maharashtra, Gujarat, Delhi and Goa and the union territory of Puducherry and employed 3,205 persons in its business operations.

Note:

Allotment in the public issue of debt securities shall be made on the basis of date of upload of each application into the electronic book of the stock exchange. However, on the date of oversubsc ription, the allotments should be made to the applicants on propo rtionate basis. For further details, refer section titled “Issue Related Informa ti on”on page 142 of the Prospectus dated March 25, 2021.

LISTING: The NCDs offered through the Prospectus are proposed to be listed on the BSE Limited (“BSE”). Our Company has obtained ‘in-principle’ approval for the Issue from BSE vide its letter dated March 23, 2021. BSE shall be the Designated Stock Exchange for the Issue.

DISCLAIMER CLAUSE OF BSE: It is to be distinctly understood that the permission given by BSE should not in any way be deemed or construed that the Prospectus has been cleared or approved by BSE nor does it certify the correctness or completeness of any of the contents of the Prospectus. The investors are advised to refer to the Prospectus for the full text of the Disclaimer Clause of the BSE Limited.

DISCLAIMER CLAUSE OF RBI: The Company is having a valid Certificate of Registration dated April 13, 2002 and a Fresh Certificate of Registration dated January 1, 2014 bearing Registration No. N-16.00175 issued by the Reserve Bank of India under Section 45 IA of the Reserve Bank of India Act, 1934. However, RBI does not accept any responsibility or Guarantee about the present position as to the financial soundness of the Company or for the correctness of any of the statements or representations made or opinions expressed by the Company and for repayment of Deposits/Discharge of Liability by the Company.

DISCLAIMER CLAUSE OF CREDIT RATING: The Company has received rating of ‘IND BBB’: Outlook Stable’ by India Ratings and Research Private Limited vide its letter dated March 5, 2021 for the NCDs proposed to be issued pursuant to the Issue. The rating of the NCDs by India Ratings and Research Private Limited indicate that instruments with the rating are considered to have moderate degree of safety regarding timely servicing of financial obligations and carry moderate credit risk. The ratings provided by India Ratings and Research Private Limited may be suspended, withdrawn or revised at any time by the assigning rating agency and should be evaluated independently of any other rating. These ratings are not a recommendation to buy, sell or hold securities and Investors should take their own decisions. Please refer to Annexure II on page 258 of the Prospectus dated March 25, 2021 for the rationale for the above rating.

DISCLAIMER: Muthoottu Mini Financiers Limited is subject to market conditions and other considerations, proposing a public issue of Secured Redeemable Non-Convertible Debentures and Unsecured Redeemable Non-Convertible Debentures has filed the Prospectus with the Registrar of Companies, Kerala and Lakshadweep, BSE Limited and SEBI (for record purposes). The Prospectus is available on the website of the Company at www.muthoottumini.com, on the website of the stock exchange at www.bseindia.com and the website of the Lead Manager at www.vivro.net. All investors intending to participate in the public issue of NCDs by Muthoottu Mini Financiers Limited should invest only on the basis of information contained in the Prospectus dated March 25, 2021. Please see section entitled “Risk Factors” beginning on page 15 of the Prospectus for risk in this regard.