Laxmi Organic overall subscribed 106.74 times on closing day

- Best QIB Interest amongst Specialty Chemical IPOs over the past 4 years-

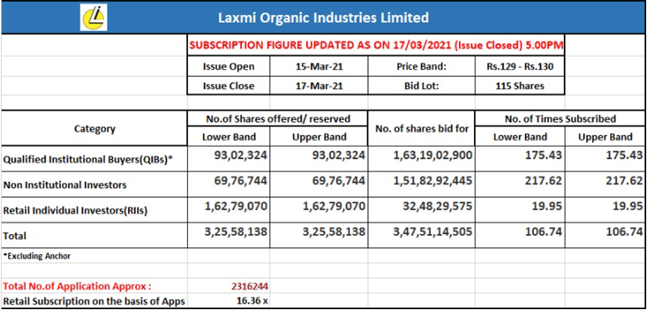

Chennai, March 17, 2021: Laxmi Organic Industries Limited (Laxmi Organic), a Mumbai based specialty chemicals manufacturer and the largest manufacturers of ethyl acetate in India, as per Frost & Sullivan Report; received bids of 3,47,51,14,505 shares against the offered 3,25,58,138 equity shares, as per the 5:00 pm data available on the bourses.

Laxmi Organic observed the highest number of bids in the QIB category, between 2018-2021, with 175.43 times subscription which is the best QIB Interest accrued in an IPO amongst its peers pertaining to the Specialty Chemical segment. The Retail category was subscribed the second highest, at 19.95 times. The Non-Institutional Investor category was subscribed 217.62 times.

The number of applications received were approximately 23,16,244.

The total size of the offer is Rs. 600 cr at the upper price band of Rs. 130 per share.

The offer consists of a fresh issuance of equity shares aggregating up to 300 Cr and an Offer for sale of equity shares aggregating up to Rs 300 cr; of face value of Rs 2 each. The minimum bid lot is of 115 equity shares, the reafter in multiples. The price band has been fixed at Rs. 129 – Rs. 130 per Equity Share.

Laxmi Organic is currently among the largest manufacturers of ethyl acetate in India with a market share of approx imately 30% of the Indian ethyl acetate market. The Company believes that the diversification of its product portf olio into varied chemistries in Specialty Intermediates has enabled them to create a niche for themselves. Laxmi Organic is the only manufacturer of diketene derivatives in India with a market share of approximately 55% of the Indian diketene derivatives market in terms of revenue in Fiscal 2020 and one of the largest portfolios of diketene products. The Company has long-standing relationships with marquee customers like Alembic Pharma ceuticals Limited, Dr. Reddy’s Laboratories Limited, Hetero Labs Limited, Laurus Labs Lim ited, Macleods Phar ma ceuticals Private Limited, Mylan Laboratories Limited, Neuland Laboratories Limited, Suven Pharmaceutic als, Granules India amongst others.

The Asia-Pacific market dominated the global acetyls market in 2019 owing to the increasing demand from end use applications like coatings, adhesives, sealants and elastomers (CASE), food & beverage and pharmaceuticals segm ents. Moreover, the rising geriatric population coupled with the affordability of generic drugs is expected to fuel the demand in the region. With many multinational players investing in India for manufacturing, active players such as Laxmi Organic would benefit the most in the growing industry scenario.

Axis Capital Limited and DAM Capital Advisors Limited are appointed as the BRLMs to the Issue.