46% of millennials report an improved credit score in FY22: OneScore Report

Witnesses 26% fall in late/deferred payments among millennial & Gen Z users

- 163% rise in the number of new consumers actively monitoring their credit score

- Number of Gen Z actively monitoring their credit score increased by over 2.5 times in FY22 vis-à-vis FY21

- Average credit score of millennial and Gen Z users stood at 715 in FY22

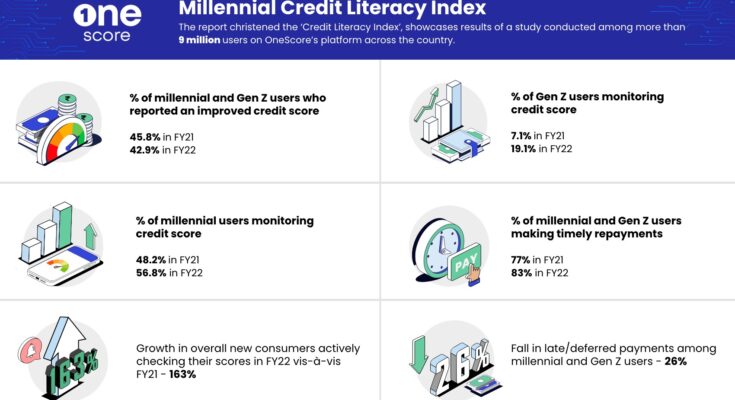

Pune, 14th September 2022: OneScore, India’s leading tech-based credit score monitoring platform, which enab les one to keep a regular check on their credit health, today said that millennials and Gen Z consumers are now be coming increasingly conscious of their credit and money management habits. The report, christened the “Cre dit Literacy Index’, showcases the results of a study conducted among more than 9 million users on OneScore’s platform across the country. According to this report, more than 46% of millennial and Gen Z users reported an improved credit score in FY22.

The report highlighted that consumers are becoming more credit-conscious and taking an active role in manag ing their credit health. Millennial and Gen Z cohorts especially are actively undertaking self-monitoring of their credit score. The platform witnessed that over 56.8% of millennials actively monitored their credit score in FY21 vis-à-vis 48% in FY21. Whereas, in the case of Gen Z consumers actively monitoring their credit score, the platfo rm witnessed a growth of over 2.5 times, from 7.1% in FY21 to 19.1% in FY22. The platform also stated that it w tnessed a 16% jump in the average number of times millennials monitored their credit score annually.

Additionally, there was a massive jump of 163% in overall new consumers actively checking their scores in FY22 vis-à-vis the same period last year. The study observed that owing to the rising credit consciousness and regular monitoring of credit scores, the platform witnessed a 26% fall in late/deferred payments among the millennial and Gen Z audiences.

The study also highlighted growing awareness among the cohort for paying credit card bills on time thereby portraying positive financial behaviour. The platform witnessed more than 83% of millennial and Gen Z users make timely repayments in FY21 vis-à-vis 77% in FY21.

The platform observed that the average credit score of users was almost unchanged at 715 vis-à-vis 714 in FY2 1. The data indicated that there was an impending need for users to up the ante in terms of more responsible cre dit behaviour, to improve their credit score. While a credit score of 715 is considered fair, there is enough room for improvement. It also stated that the number of consumers having a mediocre score, i.e., score range of 300-747 remained stagnant at approximately 63% in FY21 and FY21.

Kerala ranked highest when it comes to credit-conscious, self-monitoring millennials with an average credit sco re of 726, followed by Gujarat, Chandigarh and Delhi with an average credit score that was above 720. Whe reas, Bihar and Assam featured at the bottom of the list with an average credit score hovering at around 700.

Speaking on the trends, Anurag Sinha, CEO & Cofounder, OneScore & OneCard, said, “Comprising the country’s largest workforce, millennials and Gen Z are driving a paradigm shift in the way India consumes credit. But even with un hindered access to credit and rising disposable income, this cohort is growing increasingly credit-conscious. Mill e nnials and Gen Z have a reputation for not being the savviest with their finances, however, this trend can be se en to be rapidly changing. There is growing awareness of the benefits of a good credit score and responsible cred it management among the cohort which enables one to avail benefits such as increased access to pre-approved loans, lower interest rates, and longer tenures among others.”

“Besides self-monitoring and regular checking of credit scores, they are proactively implementing simple actions in their daily life, such as conscious spending, making on-time and full payments, etc. to improve their credit scor e. At OneScore, through personalised insights and a seamless mobile-first digital interface, we have been driving credit education and consciousness to empower our consumers to alter their credit behaviour and accordingly p lan their future credit products,” he added.

Launched in July 2019, OneScore helps customers get free, unbiased and privacy-guaranteed access to their cre dit score. Its AI-based score planner offers detailed, customised insights into one’s credit score, which helps one to improve and maintain an above-average credit score. OneCard offers premium metal credit cards to all its us ers. In the recent Series C funding round, OneScore and OneCard, part of Pune-based FPL Technologies, raised funding of $75 million taking their valuation to $750 million.

About FPL Technologies

FPL Technologies was founded by Anurag Sinha, Rupesh Kumar, and Vibhav Hathi, who come from banking ba ck grounds with deep expertise in payments, credit and building and scaling digital businesses. FPL is on a miss ion t ore-imagine credit and payments from first principles. The OneCard & OneScore apps can be downloaded from https://www.getonecard.app/ and https://www.onescore.app respectively.